As a parent, we all know about credit and how important it is for pretty much everything. From getting a home, job, vehicles and everything else you can think of. Growing up that wasn’t always the case because, quite frankly my parents didn’t team me about it. Honestly, I didn’t know anything about credit until it was too late because I didn’t have any. When I went to get me a car, I heard that having no credit is worse than having bad credit. Now that I’m a parent myself, I don’t want my kids to suffer the same fate. When my son got his first job at 16, my wife and I decided to start building up his credit. Now that he’s 18-years-old and about to graduate from high school, that’s one of the best decisions we’ve ever made. Below are a few things we done for him:

Educate Your Child About Credit

First things first, you have to educate your child about credit and how it works. With our son, we told him about avoiding any kind of credit card debt and paying any bill you have on-time. When they get older, it will help them find an apartment or get a really good interest rate on a nice vehicle. When it comes to getting a loan or credit card, the interest rate is key and can save you hundreds or even thousands of dollars. They must be really responsible because one late payment could damage their credit for a long time. Nowadays, when they’re pursuing a really good job out of school you’ll need good credit also.

Make Them an Authorized User on Your Credit Card

After educating them about having good credit, you can authorize them as a user on your credit card. Being an authorized user on a credit card means that they can use it anytime they want. Before doing this, educate them and use this as a way to make them more responsible. With my son, he knew that if he uses any of those authorized cards, he was paying the bill. As long as you all are making the payments on-time, his credit score will continue to rise.

He’s an authorized user on 4 of our credit cards, which is a pair of Capital One and JCPenny’s and Old Navy since he like shopping at those places. He’s been an authorized user with those cards for almost 2 years now. For those two years, we always keep our balances low and pay the cards on time all the time.

Co-Sign with Them on A Card

After your child, has shown they’re responsible, you may want to co-sign to help get them a credit card. It’s pretty difficult for them to get one if they’re under 21 because of the CARD Act of 2009. As a co-signer, you have no control of the account and if they don’t pay it then you’re responsible for it. This goes back to how much you trust your child and if you think they’re ready for this big step.

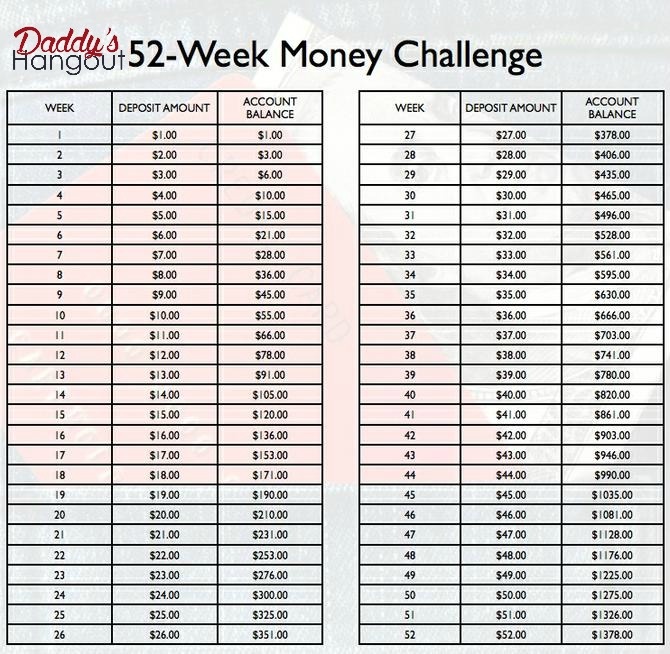

Get Them to Save Money

This is probably one of the harder things to do for a teenager, but it’s possible. Last year, my son saw I was doing the 52 Week Challenge and thought he would try it. By the end of the year, he saw that he had over a thousand dollars by just putting a little to the side. The 52 Week Challenge is simple, just put back the amount of money for the week. For example, on Week 10 you would put back ten dollars and by the end of the year you should have $1378.

Personal Story

As mentioned above, we started my son’s credit at 16 and now he’s 18-years-old. He wanted to upgrade his car and was willing to make the payments on it. When the dealership pulled his credit, they were amazed seeing someone his age with a credit score in the mid-700s. He’s now the owner of the car he loves with a really low interest rate and small payments. As a graduation gift, I put some money down on it and I had to co-sign since he’s only 18 years old.