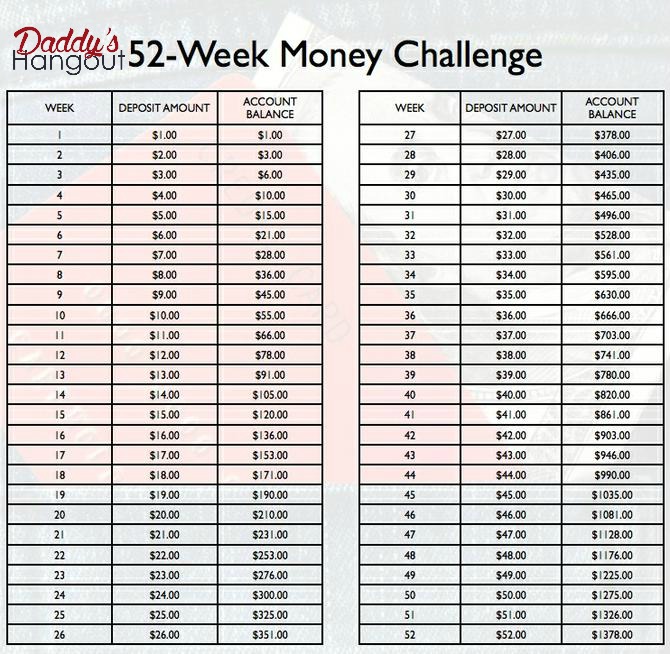

I don’t know about any of you all, but I’m glad that 2016 is over with. While I had great moments this past year, the year 2016 seemed depressing to me. Actually, talking to several other people; well, you know that barbershop talk; many others felt the same way. I can’t nor will I pinpoint one event that made me feel that way, but 2016 felt like a year of hatred. It was all capped off with so much death, whether it was celebrities or people, I knew growing up. The year 2017 will be a much better year, and I’ll start by doing the money challenge I did in 2015. Here are a few reasons you should follow suit and join me for the 52-week money-saving challenge.

Save Money for a Rainy Day

No matter how good things seem to be going, those rainy days could hit you pretty quickly. For those who don’t understand the term of “rainy days”, well, this is what we talk about something unexpected happens. Whether it’s car problems, something breaking in your house, kids getting sick or whatever can happen when you least expect it. Trust me, it’s always good to have a stash for moments because you don’t want to borrow money from one of those high-interest loan places, be stuck or run up your credit cards.

Christmas Money

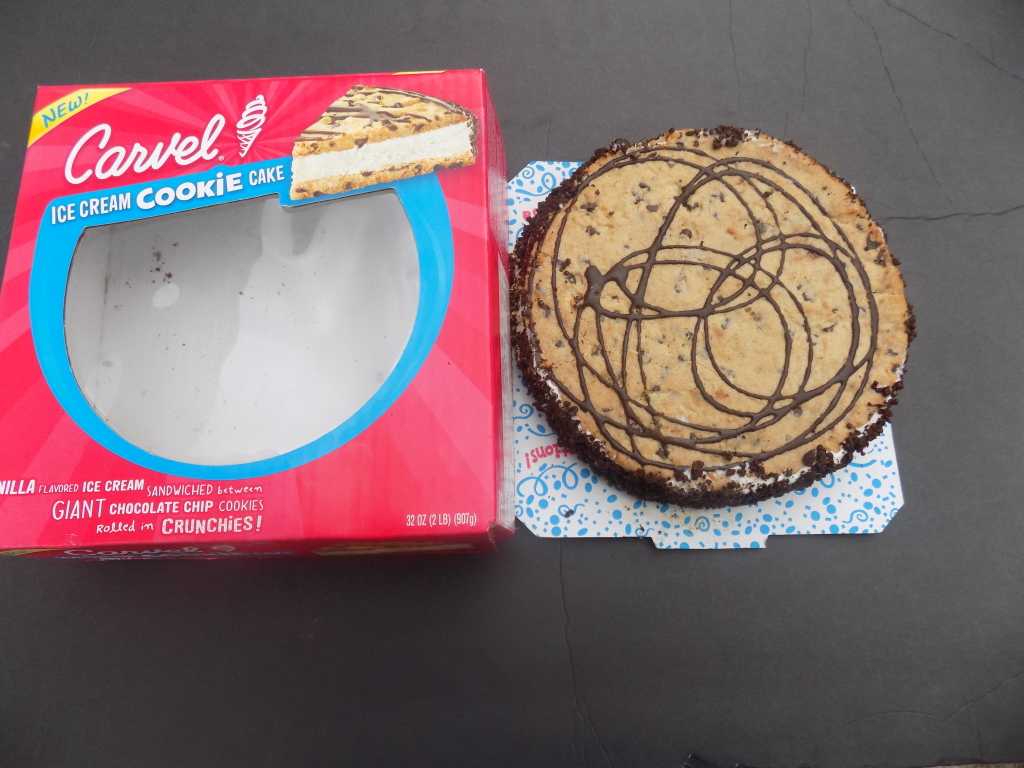

In 2015, I was responsible enough to put money in two separate accounts. In return, I bought all my Christmas on a couple of credit cards where I earned money right back. Fortunately, I paid my balances off as I made purchases and my credit score increased in the process. Think about it, I managed to save almost $2800, which is about the amount I spent on my entire family. This was made possible by just putting a little money back that I probably would’ve blown on something stupid.

Add to Your Savings Account

Some employers actually offer their employees a chance to be a part of Christmas Savings Clubs. They allow them to put back a certain amount of their check into an account and they withdraw it around Christmas time. If you do the 52-week money saving challenge, the money you save can be transferred to your savings account. If you’re like me, then you’re probably having a set amount going in that account already. In five years of doing this challenge, you can add almost 7k to your account by just saving a few dollars. In the process, this is a great way to teach your kids about saving money.

Vacation Time

Another thing you can do is start funding your 2018 vacation with this challenge. Normally, my wife and I have a separate account to put money back for a family vacation. If you already have money put to the side for emergencies, then this is a perfect way to save for vacation. This is something I’m thinking about for 2018 because we said we’re going on vacation for the holidays that year. We’re already saving money for those rainy days and we have a health savings account just in case the kids get sick, my focus will be holiday vacation in 2018.

Will you be taking the 2017 52-week money saving challenge with me? If so, what are some of the reasons you like to save your money? Head to the comments section below and give me some feedback.