Money in any form appeals to every individual. However how one perceives it differ from one to other. Saving and expenditure both lead to the ultimate financial stability of a person. Hence allocating money wisely is of utmost importance. But one should make an informed decision by weighing different options from varied sources. Simply relying on suggestions from friends, family or professionals may not be the best decision. While you take a financial decision you also need to be vary from various money myths prevailing in the market. Let’s discuss few common money myths that you may come across.

- Credit cards are bad: Yes, they are bad only if you don’t spend responsibly. You can prevent paying any interest by paying your credit card bills bi-monthly and keeping a check on your expenditure. Credit cards also helps you build a credit score. And going back to the 1st point, in modern life credit score is essential for building both financial and personal credibility.

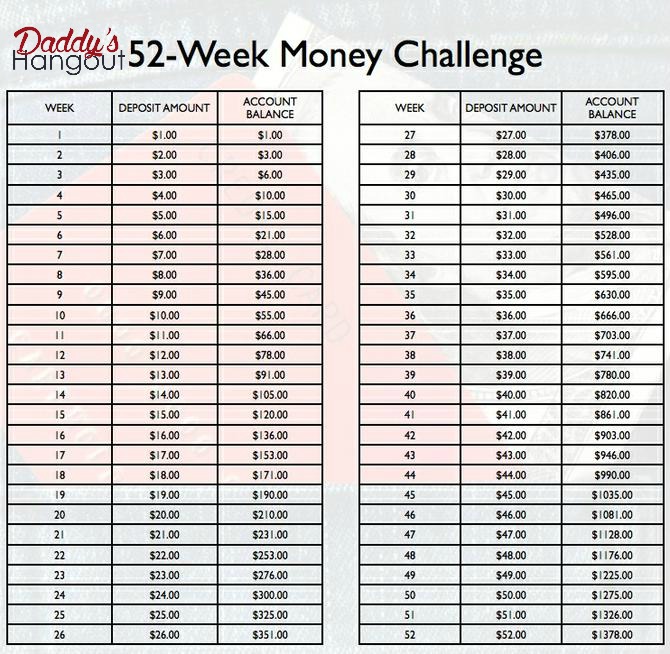

- You can start saving for retirement later: The time is NOW! You need to start saving today to achieve your retirement goals. With inflation, value of money keeps decreasing which means you need to save more today as compared to tomorrow. So do not delay and start saving today for a better life post retirement.

- Invest in Real estate: Everyone dreams of having their own house. But blindly investing in real estate is not the answer.Real estate bubbly could burst. Also value may appreciate in one market and not in another. You need to comprehend your potential and needs before making such decision. Don’t let peer pressure affect your decision. Renting is a perfectly good option if you can’t purchase in your current scenario. Make sure you budget well before investing in real-estate. Invest only in what you can afford to repay if u take a debt.

- Stock market is too risky: All modes of investment have their share of risks and so does stock market. But more often than not if you invest wisely and keep a check on it you are bound to gain some benefit. Remember to follow the thumb rule – don’t put all your eggs in one basket. This means that don’t bet all your money in 1 stock alone and invest in multiple shares/funds/options. So if 1 stock doesn’t give you returns you still have others to gain from.

- Buy bulk in Sale: Online shopping especially during Sales is the latest trend. Stocking upitems just because they are on sale is not clever. Companies do not negate their margins during sales.In fact they only marginally reduce the price to lure consumers. Instances of increased pricing have also been noted during sale season to show higher discounts being given. So don’t be fooled and go berserk during such periods.

Now that we have cleared a few myths here, go ahead, make a wise decision!

Please follow and like us: